Inventory optimization tools can help set accurate reorder points and safety stock levels. Regularly review inventory performance and adjust based on sales trends and market conditions to maintain the optimal balance. Depending on the nature of your products, implementing a FIFO or LIFO inventory management system can help you manage inventory more effectively. LIFO, on the other hand, is beneficial in situations where product costs are rising because it allows you to match current costs with current revenues.

Camp Operation – Recreational or Educational – All Employees & Drivers

Raw materials may include sand, gravel, cement, aggregates, wire mesh or rods. Machinery such as lifts, or cranes may be used to move completed products. Code 5221 applies to employers engaged in any type of paving or repaving involving flat work with cement or concrete, such as driveways, floors, yards, sidewalks, and parking lots.

Finished Goods Inventory: Definition & How to Calculate

This operation is mostly performed by specialist contractors in this field of construction, however, this may also be done by general contractors. When an employer receives a railcar to be refurbished, they will jack up the car on stands to be worked upon. In some cases, it is not necessary for the employer to work under the railcar.

It calculates current assets and gross profit

Inventory data empowers you to make informed decisions about future purchases and resource allocation. You can identify popular styles that need to be replenished sooner and adjust your ordering patterns accordingly. This data-driven approach fosters efficient use of resources and maximizes your profit margins.

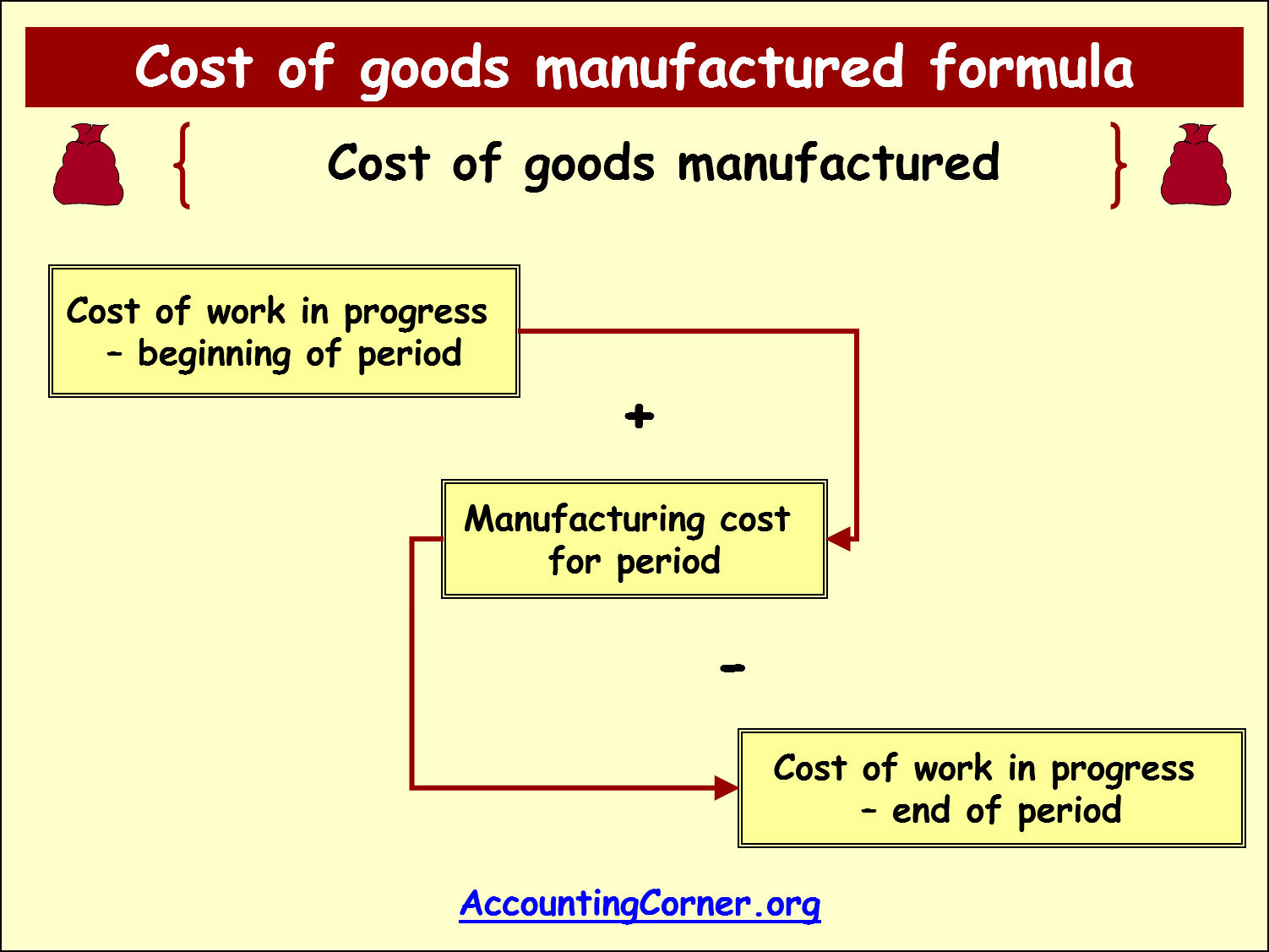

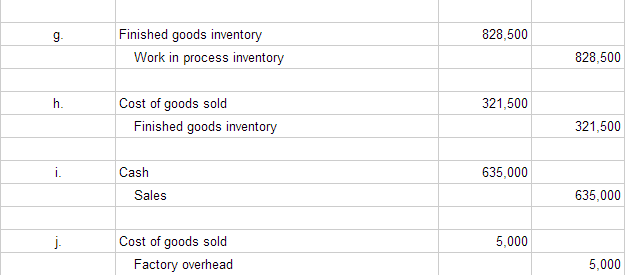

How to calculate finished goods inventory

Finished goods inventory management involves overseeing the storage, movement, and sale of products that are fully manufactured and ready for sale. Managing finished goods inventory is an important aspect of supply chain management. It allows you to keep track of how many products you have ready to sell to your customers.

This translates to happy customers who are more likely to return for future purchases and recommend your brand to others. In this article, we will explain what is finished goods, how it is important, and especially how to calculate finished goods inventory by giving you not only the formula but also some examples. The transportation mode, cost, and speed will depend on various factors such as product type, demand, location, and customer preferences.

The employer will add the necessary lighting fixtures, plumbing fixtures and control panels with the systems being wired and pipe connections made. Code 3881 applies to employers finished goods accounting engaged in manufacturing, repairing, rebuilding or dismantling railroad cars. The railroad cars manufactured may be passenger type cars, steel tank cars or gondola cars.

Finished goods inventory are the products that are ready for sale to your customers. The finished goods are then stored in warehouses or distribution centers, waiting to be delivered to retailers, wholesalers, or directly to end consumers. You won’t be able to meet customer demand and can bump into problems like overstock or stockouts. When the production process is complete, WIP inventory is transferred to the finished goods inventory. When they arrive, the raw materials are recorded in the company’s inventory system and stored so they’re available for production.

Finished goods inventory value is usually tracked by a company’s finance team or a contracted accountant. The classification of finished goods inventory is relative to the business. Products that are categorized as finished goods by the manufacturer may later be classed as raw materials by a company that purchases them.

- That’s why Flowspace pairs powerful software with a flexible nationwide fulfillment network to support growing ecommerce brands as they optimize their supply chains and improve work in process inventory levels.

- These items have fully completed the manufacturing process, are on your warehouse shelves and are waiting to be shipped to eager customers.

- Code 5403 applies to employers engaged in general carpentry work not otherwise classified in the Manual.

- Seeing a breakdown of your inventory costs can potentially reveal opportunities to optimize operations and lower costs.

- Returns and damaged goods can complicate inventory management by adding unexpected stock that needs processing.

Finished goods inventory management tools are software applications that support the inventory management methods you have chosen to implement into your business. Inspecting, testing, and packaging the finished goods inventory according to quality standards and customer specifications is another important aspect of the production process. Purchasing raw materials from a supplier involves the negotiation of prices, contracts, and delivery terms. Extracting raw materials from natural resources involves mining, drilling, harvesting, or other methods of extraction, activities that are likely to be legislated, or require licenses and approvals. Finished goods inventory is reported as a current asset on your balance sheet.

This classification applies to managers, teaching pros or instructors, bar or restaurant personnel, swimming pool and tennis court employees and office employees. Hotel or motel employees are also subject to this classification if the employer provides these services only to their members and guests. Entertainers and musicians on the club’s premises are also subject to this classification. This classification applies to stores principally engaged in the wholesale or retail mail order sales of clothing, wearing apparel or dry goods. This classification is also applied to employers that manufacture hats but does not apply to the manufacturing of hat frames made from buckram. Straw hats are braided from straw striping and sewn or stitched together.