© 2024 KPMG LLP, a Delaware limited liability partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. We hope you find this Handbook useful in understanding how the guidance fits together and applies to financial instruments – from the simple to the most complex. Our expert tax report highlights the important issues that tax preparers and their clients need to address for the 2024 tax year. Stay informed and proactive with guidance on critical tax considerations before year-end. This course offers hands-on learning with journal entry examples that demonstrate how to apply the new standard. KPMG reports on amendments to reduce accounting models for convertible instruments and simplify contracts in own equity.

Be prepared for tax season early

Initial direct costs of $150,000 would be amortized on a straight-line basis over the 20-year period, amounting to $7,500 per year ($150,000 ÷ 20). Topic 840 required this expense to be added to rent expense to compute the total lease expense for each period. Thus, the total lease expense would be equal to $1,160,250 + $7,500, or $1,167,750. The deferred rent would be calculated as the difference between $1,160,250 and $1,000,000, or $160,250. Based on this information, entries for year 1 under Topic 840 would be as shown in the chart “Accounting for Beginning of Year 1” (below). The entry in the chart “Accounting for End of Year 1” (also below) records the first year’s lease expense (under Topic 840).

What Type of Purchase Are Prepaid Expenses?

These costs are not immediately expensed but are instead spread out across multiple periods, aligning with the revenue they help generate. This practice can significantly impact a company’s financial health and reporting accuracy. This entry records lease expense, payment, and amortization of lease liability and right-of-use asset. Of course, complications could arise at transition if leases previously classified as operating under Topic 840 now meet the criteria of financing leases under Topic 842.

Accounting Research Online

This approach ensures that expenses are matched with the periods in which the related benefits are realized, adhering to the matching principle in accounting. Properly managing prepaid expenses is crucial for maintaining accurate financial statements and avoiding the misrepresentation of a company’s financial position. The adoption of CECL has raised fresh questions related to the treatment of deferred fees and costs, particularly regarding the amortized cost basis and the allowance for credit losses estimates. The initial step in accounting for deferred costs is identifying which expenses qualify for deferral.

Accrual accounting records revenues and expenses as they are incurred regardless of when cash is exchanged. If the revenue or expense is not incurred in the period when cash/payment is exchanged, it is booked as deferred revenue or deferred charges. The accrual method is required for businesses with average annual gross receipts for the 3 preceding tax years of $25 million or more. If the borrower elects to convert the line of credit to a term loan, the lender would recognize the unamortized net fees or costs as an adjustment of yield using the interest method.

These prepaid expenses are those that a business uses or depletes within a year of purchase, such as insurance, rent, or taxes. Until the benefit of the purchase is realized, prepaid expenses are listed on the balance sheet as a current asset. Accounting for deferred costs involves a meticulous process that ensures expenses are recognized in the periods they benefit. This practice is rooted in the matching principle, which aims to align expenses with the revenues they help generate.

- This controversy may be resolved at some point as part of the accounting standard modifications, but for now US GAAP requires capitalization and amortization of deferred financing costs.

- Prepaid expenses are payments made for goods or services to be received in the future.

- Generally, we see financial institutions use their loan system to capture and amortize these net fees and costs over the contractual life.

- For example, a company with substantial capitalized development costs will see a gradual reduction in its operating margin as these costs are amortized.

For example, a company with significant deferred costs might show strong cash flow from operations despite lower net income due to the non-cash nature of amortization expenses. Deferred costs significantly influence a company’s financial statements, affecting both the balance sheet and the income statement. When these costs are initially recorded as assets, they enhance the asset base, potentially improving key financial ratios such as the current ratio and total asset turnover.

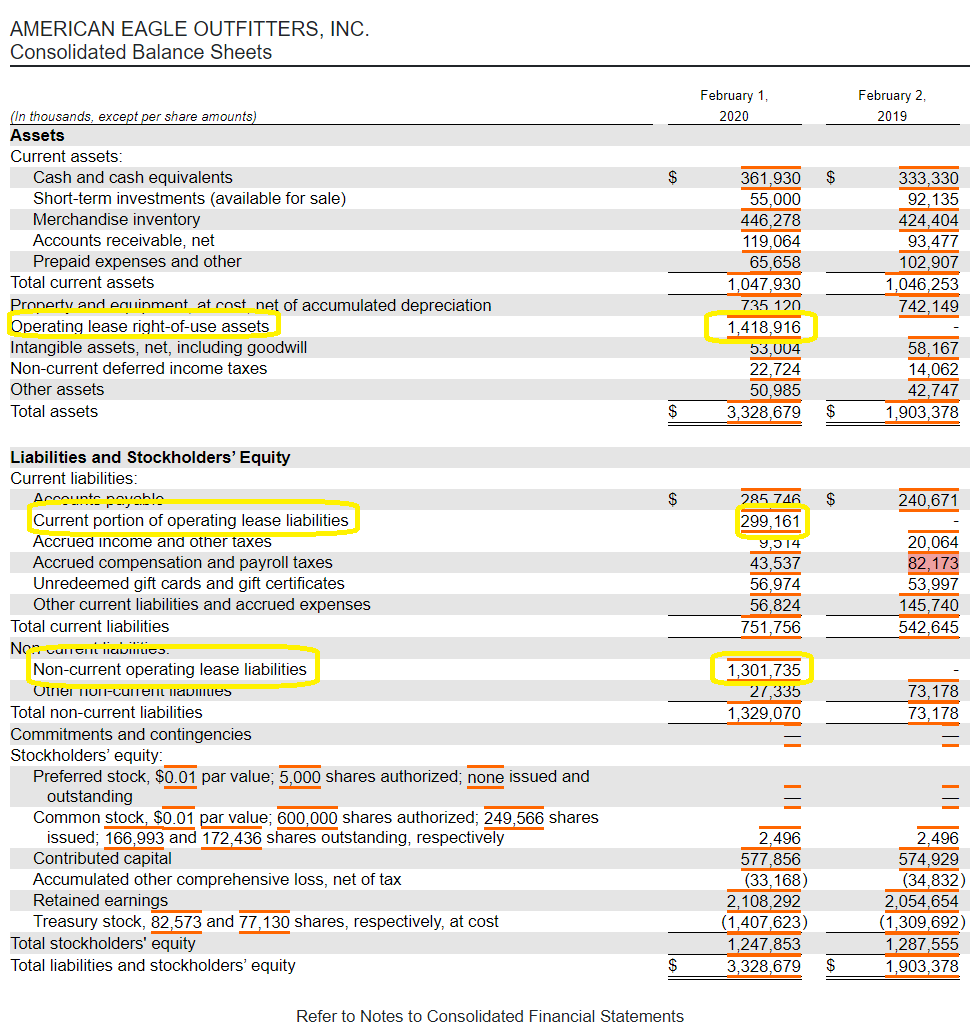

Under Topic 842, income statement effects for operating leases differ from those of financing leases. The latter classification requires the lessee to amortize the right-of-use asset over the lease term, while it requires the lessee to amortize the related lease obligation using the effective interest method. In contrast to previous GAAP, Topic 842 requires operating leases greater than one year to be recognized on the balance sheet as right-of-use assets and related lease obligations. There is no change in substance to the treatment of capital leases under Topic 840.

Prepaid expenses are payments made for goods or services to be received in the future. These costs are initially recorded as assets on the balance sheet and expensed over the period they benefit. For instance, if a company pays an annual insurance premium upfront, the cost is spread over twelve months.

This requires a thorough understanding of the nature of the expense and its future benefits. This classification is crucial as it distinguishes deferred costs from regular expenses, which are immediately expensed in the period incurred. For instance, when a company pays for a multi-year software license, the cost is recorded as a deferred expense and amortized over the license period. FASB Accounting Standards Codification (ASC) Topic 842, Leases, deferred financing costs on balance sheet issued in February 2016, marked a significant overhaul in the financial reporting of long-term leases. Where the previous guidance (FASB ASC Topic 840, Leases) was based on a risk-and-reward model, Topic 842 is based on determining whether a contract conveys the right to control the use of an identified asset. This article explains the guidance as it relates to accounting for deferred rent and initial direct cost under Topic 842.

The chart “Accounting at Lease Commencement Date” (below) illustrates amortization of the right-of-use asset and the lease liability, as well as related journal entries. Using the data in the table “Expense and Amortization Schedule,” a lessee would make the journal entries shown in that chart. This entry records the operating lease and payment of initial direct cost at the commencement date. This advanced payment is recorded as a deferred charge on the balance sheet and is considered to be an asset until fully expensed. Each month, the company recognizes a portion of the prepaid rent as an expense on the financial statements.