For example, having an annual management fee of 0.25% means you’ll have to pay the robo-advisor company $25 for managing $10,000 of investments. Keep in mind that this fee is charged on top of the expense ratio you’ll have to pay for each fund you’re invested in. Select ranked Betterment and Wealthfront as the best robo-advisor services. Robo-advisors typically charge a management fee, which, like an expense ratio, is represented as a percentage.

Categorizing Overhead Expenses

Additionally, the cost of sales to revenue ratio can be used to identify areas where a company can improve its operations. By analyzing the ratio, a business can determine which products or services are generating the most revenue and which ones are not. This information can help the company make informed decisions about where to allocate resources and which areas to focus on to increase profitability. Research and development (R&D) spending is essential for business growth and innovation. All R&D costs are operating expenses, including salaries of research personnel, cost of materials/testing, intellectual property registration fees, and amortization of R&D-related intangibles. Tracking R&D spending is vital, as high R&D expenses can significantly impact a company’s operating expense ratio.

Table of Contents

The operating expense ratio formula is crucial for evaluating a company’s operational efficiency and profitability. It helps assess the proportion of operating expenses to net revenue, providing insights into cost management and revenue generation. This ratio aids in making informed decisions, identifying cost-saving opportunities, and comparing financial performance with industry peers. The expense to revenue ratio is a crucial financial metric that measures a company’s operational efficiency by comparing its expenses to its revenue. It is calculated by dividing a company’s total expenses by its total revenue. This ratio serves as a valuable tool to assess the effectiveness of a company’s cost management strategies and identify areas for improvement.

What Can Profitability Ratios Tell You?

This allows for a more accurate evaluation of whether a particular expense ratio is competitive within its specific market segment. Putting those data points together, good places to begin include S&P 500 index funds as either an ETF or mutual fund, though an ETF is likely the better option. Some of the cheapest funds are index funds based on the accountant partners payroll and hr software Standard & Poor’s 500 index, a collection of hundreds of America’s top companies. These funds regularly charge less than 0.10 percent and range all the way to free. A high ROE can be a sign to investors that a company may be an attractive investment. It can indicate that a company has the ability to generate cash and not have to rely on debt.

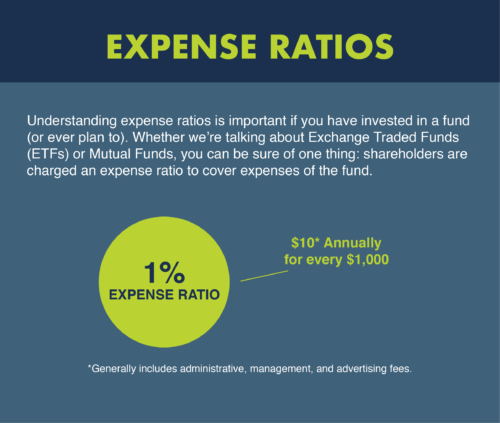

- Lower expense ratios can lead to higher returns over time, which can make a substantial difference in the growth of an investment portfolio.

- ✔ By analyzing and optimizing this ratio, you can unleash opportunities to skyrocket your profits, gain a competitive edge, and become a champion of economic challenges.

- Different B2B industries have unique cost structures and revenue recognition methods.

When you aim to generate business leads, you need to eliminate uncertainties in your profit calculations. Your goal is to align your sales targets precisely with your budget constraints. Add up all the costs identified in Step 1 to calculate the total cost incurred by your business.

Why Is Expense Ratio Important?

By analyzing and optimizing the expense to revenue ratio, companies can identify opportunities to maximize profits. This can be achieved through various strategies such as reducing unnecessary expenses, increasing operational efficiency, improving pricing structures, or expanding revenue streams. Conversely, a low expense to revenue ratio signals that a company is efficiently managing its costs and generating healthy profits. It indicates that the company’s revenue is outpacing its expenses, reflecting effective cost-control measures and financial stability. A high expense to revenue ratio indicates that a company is spending more money than it is earning, which can be a warning sign of financial distress.

Different profit margins are used to measure a company’s profitability at various cost levels of inquiry. These income statement profit margins include gross margin, operating margin, pretax margin, and net profit margin. The margins between profit and costs expand when costs are low and shrink as layers of additional costs (e.g., cost of goods sold (COGS), operating expenses, and taxes) are taken into consideration.

Additionally, the formula may not be suitable for comparing companies of varying sizes or industries, as cost structures differ. Using the ratio alongside other metrics for comprehensive financial analysis is essential. A good operating expense ratio for a business depends on the industry and company’s specific circumstances. A lower ratio indicates better operational efficiency, as a higher proportion of revenue is retained as profit.

Net sales, rather than total revenue, is used in the formula to account for returns, allowances and discounts which reduce the amount actually collected. Using net sales provides a more accurate picture of the operating expense ratio. Companies with higher returns and allowances will have lower net sales, resulting in a higher operating expense percentage. Using a simple accounting formula called the operating expense ratio provides valuable insights to trim expenses. Mastering this financial metric can lead to improved profit margins and financial success. So, if you have $5,000 invested in an ETF with an expense ratio of .04%, you’ll pay the fund $2 annually.